Okay welcome to uh this month's brown bag today we'll be reviewing patch 388 which is uh targeted for release tomorrow before I begin I'm going to ask the TMO if they'd like to add any comments before I get started yeah good afternoon good morning everybody um glad to have a good turnout here looks like we're getting close to 200 folks online so that's good to see the release notes and I'll take that back the slides being covered today are in the available in the km portal so if you want to go take a look at them there they are and I'll throw the link to that in the chat here or maybe I can't trying to chat and it won't let me press send anyway hopefully you all have access and know where the km portal is at for construction management and the RMS page any TMO email that's been sent recently has that link and the slides are there and then later today we will get out a email with the patch 388 release notes and the slides from today's presentation attached to our user dll so look for that a little later today and um welcome to the training and I'll let uh turn it back over to the the team to get started thanks okay so to get started like I said we'll be reviewing patch 388 and reviewed where all the documentation related to this can be found please feel free to use the Q a section in this WebEx to ask any questions you may have we do have some RMS support center folks on standby to address those okay so here are the topics we will be covering we will be looking at the document package dredging some report...

PDF editing your way

Complete or edit your 4025 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export eng form 4025 r directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 4025 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your eng form 4025 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Eng Form 4025-R

About Eng Form 4025-R

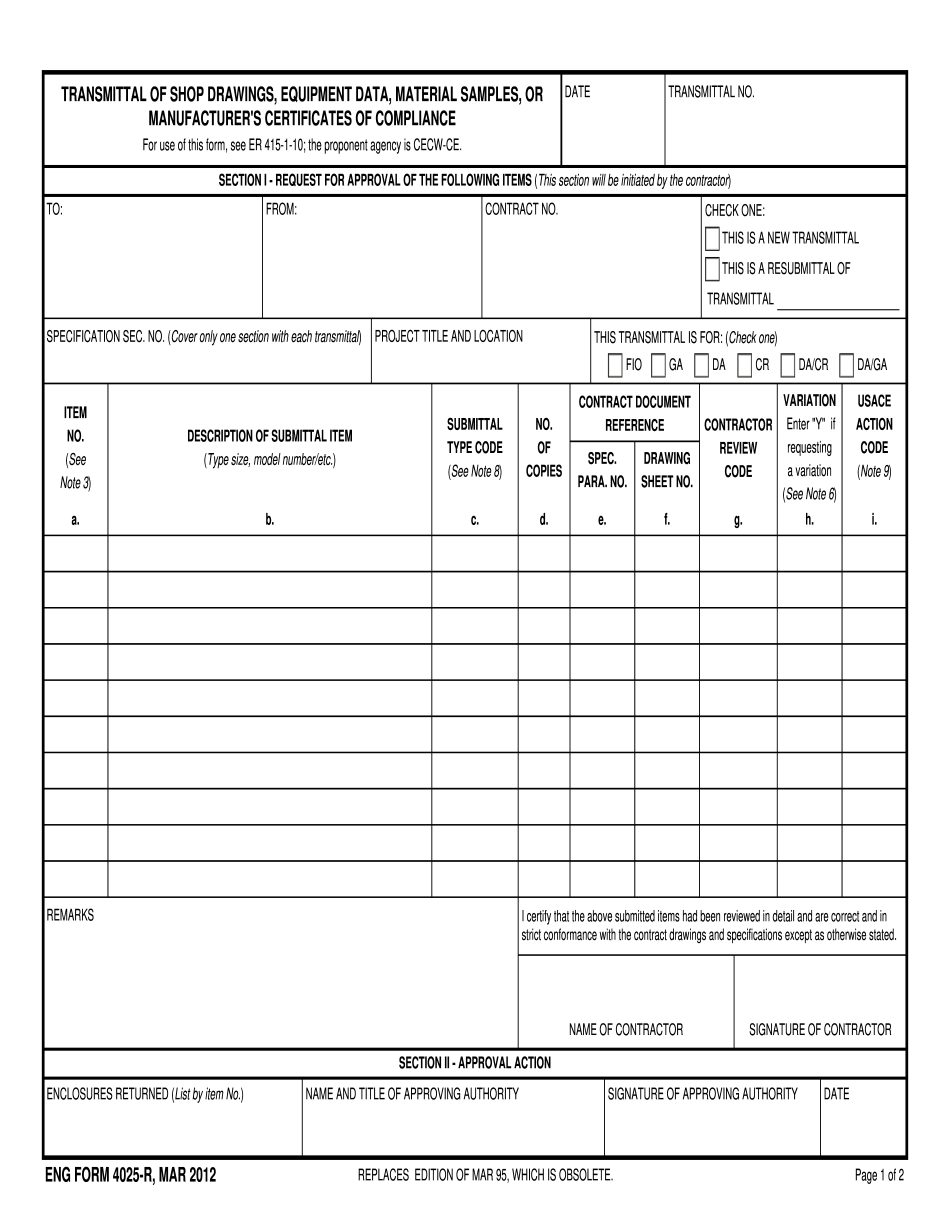

Eng Form 4025-R is a form used by the United States Army to record the maintenance and repair history of their aircraft. It is used by maintenance personnel to document inspections, repairs, and modifications made to the aircraft, as well as to track the usage of aircraft components such as engines, avionics, and airframes. This form is required by all military aviation units, including the Army National Guard and U.S. Army Reserve. It is also important for civilian contractors and flight schools that operate military aircraft to maintain accurate records and comply with federal regulations. The use of Eng Form 4025-R helps ensure that military aircraft remain in safe and operational condition, and enables proper tracking of maintenance and repair costs.

Online technologies allow you to organize your document management and raise the productiveness of the workflow. Follow the quick tutorial in an effort to fill out Eng Form 4025-R, stay away from mistakes and furnish it in a timely way:

How to complete a Eng Form 4025?

-

On the website hosting the document, click on Start Now and go to the editor.

-

Use the clues to complete the relevant fields.

-

Include your individual data and contact details.

-

Make certain that you choose to enter proper data and numbers in appropriate fields.

-

Carefully check out the written content of your form so as grammar and spelling.

-

Refer to Help section in case you have any concerns or address our Support staff.

-

Put an electronic signature on the Eng Form 4025-R printable with the help of Sign Tool.

-

Once document is completed, press Done.

-

Distribute the ready blank by means of email or fax, print it out or download on your device.

PDF editor lets you to make alterations to your Eng Form 4025-R Fill Online from any internet connected gadget, customize it in accordance with your requirements, sign it electronically and distribute in different means.

What people say about us

Complex paperwork, simplified

Video instructions and help with filling out and completing Eng Form 4025-R